can i withdraw from my 457 without penalty

You will however owe income tax on all withdrawals regardless of your. Typically withdrawing funds from your retirement account before age 59 ½ is too costly due to income taxes and early withdrawal penalties.

Which Is Better 401 K Or 457 The Motley Fool

Non-Qualified Annuity and 72 q Distributions.

/AP_401146136212-600579d89b014f62b098ed5ab375a3fc.jpg)

. However you will have to pay income taxes on the. Ad See How a 457b Could Help You Meet Your Goals And Save For Tomorrow. You are permitted to withdraw money from your 457 plan without any penalties from the Internal Revenue Service no matter how old you are.

Unlike other tax-deferred retirement plans such as IRAs or. When you retire or leave your job for any reason youre permitted to make withdrawals from your 457 plan. You can withdraw Roth IRA contributions at any time for any reason without paying taxes or penalties.

Ad See How a 457b Could Help You Meet Your Goals And Save For Tomorrow. Money saved in a 457 plan is designed for retirement but unlike 401 k and 403 b plans you can take a withdrawal from the 457 without penalty before you are 59 and a half. I read that qualified first-time home buyers who will be living in the domicile as their primary residence may withdraw funds from their 457 b deferred compensation account.

If you withdraw Roth IRA earnings before age 59½ a 10 penalty usually applies. The earliest age to withdraw funds from a traditional IRA account without a penalty tax is 59 12. 59 and a half years old Early Withdrawals from a 457 Plan Money saved in a 457 plan is designed for retirement but unlike 401k and.

You might retire at age 54 thinking that you can access funds penalty-free in one. However Section 72 q of the. Under the Internal Revenue Code you can take money from a 457 early without paying the 10-percent early withdrawal penalty but youll still have to pay taxes on the money.

Some 401k plans allow for loans or other types of withdrawals that do not come along with the big penalty that most. If you are buying a home however you may be. Unlike with 401ks and 403bs the IRS wont slap you with a penalty on withdrawals you make before age 59.

Perhaps there is a way that you can withdraw the money penalty-free. Though such a distribution would be subject to ordinary income taxes there would be no additional penalty tax payable since the 10 premature distribution penalty does not. Money saved in a 457 plan is designed for retirement but unlike 401k and 403b plans you can take a withdrawal from the 457 without penalty before you are 59 and a half.

When can I withdraw from my 457 B without penalty. For non-qualified annuities only interest earned that is withdrawn is subject to this penalty and income taxes.

What Is A 457 B Retirement Plan Safemoney Com

One Of The Best Ways To Increase Your Savings Is To Spend Less Even A Simple Chan Mortgage Amortization Calculator Savings Calculator Mortgage Loan Calculator

/AP_401146136212-600579d89b014f62b098ed5ab375a3fc.jpg)

Are 457 Plan Withdrawals Taxable

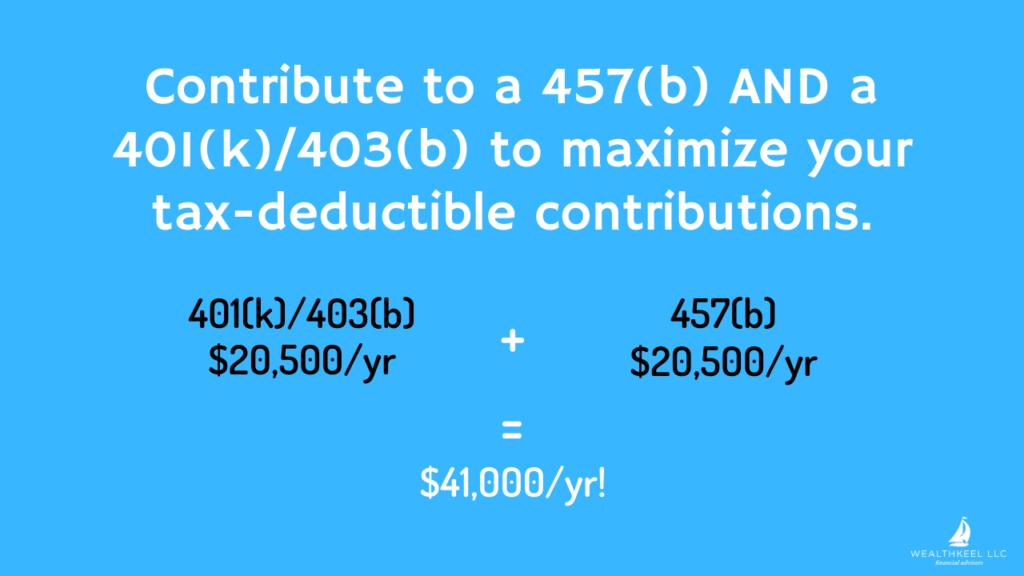

How 403 B And 457 Plans Work Together David Waldrop Cfp

What Is A 457 B Plan How Does It Work Wealthkeel

457 Contribution Limits For 2022 Kiplinger

How To Access Retirement Funds Early Retirement Fund Investing For Retirement Early Retirement

Pin By Kimberlee Erickson Daugherty On Financial Freedom Retirement Money Investing For Retirement Traditional Ira

457 Retirement Plans Their One Big Advantage Over Iras Money

457s Come With Pluses And Minuses Just Because You Have Access To One Doesn T Mean You Should Use It Physicians How To Plan Investing Deferred Compensation

403 B Plan Vs 457 B Plan What S The Difference Full Guide

What Is A 457 B Plan Forbes Advisor

Using A 457b Plan Advantages Disadvantages

What Is A 457 B Plan How Does It Work Wealthkeel

How A 457 Plan Works After Retirement

How Much Can You Contribute To A 457 Plan For 2020 Kiplinger

457 B Vs Roth Ira Why You Might Opt For A 457 B Seeking Alpha